Volkswagen Showroom and Servicing Facility

Volkswagen Showroom and Servicing Facility

DMC projects have been engaged by Autosports Group to deliver planning and adjoining neighbour easement strategy, that will enable the development of an entirely new Volkswagen Showroom and large basement servicing facility at the busiest intersection in Queensland (corner of Mains and Kessels Rd, MacGregor).

Read More

Grindle Rd – Industrial Facility

Grindle Rd – Industrial Facility

117 Grindle Road Rcoklea is a modern, secure, eight-warehouse industrial facility designed and constructed with heavy vehicles in mind. DMC Projects was commissioned by Quinnessential Equity to deliver the bare building upgrades to the asset including the design and installation of a storage sprinkler system to allow for full height racking, along with upgrading the external car parking, hardstand and landscaping zones.

Read More

Abronia Apartments, Rochedale

Abronia Apartments, Rochedale

PASK Group have appointed DMC Projects as Development and Project Managers for their Abronia Apartment development that consists of a series of 5 boutique apartment buildings, located within the Arise master-planned community at Rochedale. Whilst BCC Development Approval had already been granted for this site, DMC Projects handled a change application to increase density, simplify the overall design and reduce the commercial component under the current approval.

Read More

Valley Heart – TC Beirne Building Duncan Street Car Park

Valley Heart – TC Beirne Building Duncan Street Car Park

DMC Projects was appointed to provide Development and Project Management services to the TC Beirne & Co project as part of its ongoing investment and management of the project with AsheMorgan. The rejuvenation of the TC Beirne Building being a State listed Heritage Building containing 15,000m2 of NLA focussed on returning the fabric of this important structure to a multipurpose mixed-use asset.

Read More

Ivy & Eve Residential Apartments

Ivy & Eve Residential Apartments

DMC Projects was commissioned to provide Project Management services in relation to the development of a large residential apartment complex in South Brisbane. The project known as Ivy and Eve on Merivale Street contains 468 – 1, 2 & 3 bedroom apartments in a prime location with expansive views over the Brisbane CBD skyline.

Read More

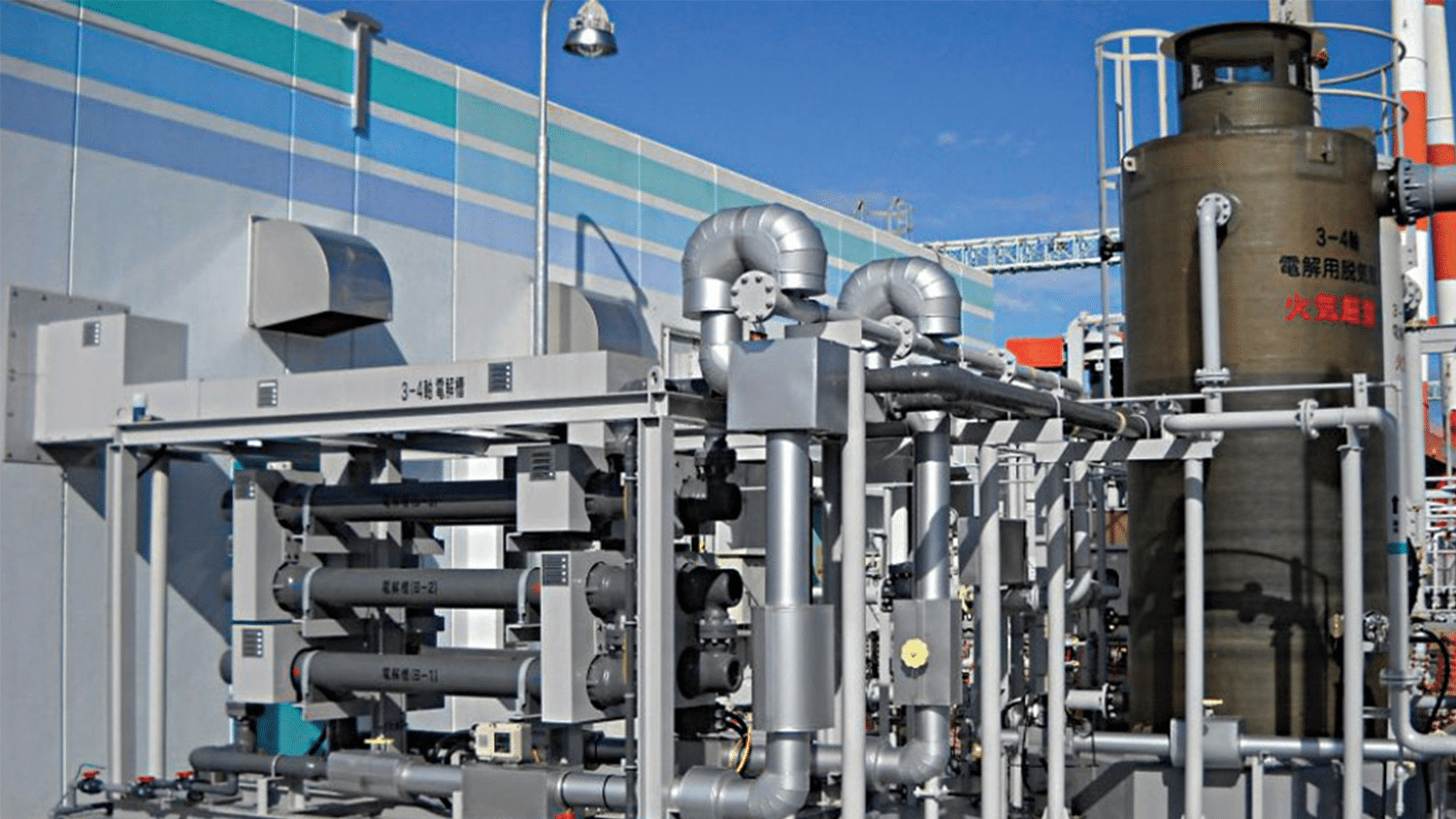

Chlor-Alkali Production Facility

Chlor-Alkali Production Facility

DMC Projects have been appointed to project manage the design, supply, construction, installation and commissioning of a proposed Chlor-Alkali facility located on the Sunshine Coast in conjunction with Japanese specialist De Nora Permalec Ltd. Outside of our usual PM services employed this project, it also involved specialist process engineers and HAZOP reviews to ensure the safe storage and handling of goods as well as strict code compliance with Australian Standards.

Read More

Birkenhead Point Redevelopment

Birkenhead Point Redevelopment

Development and Project Management services were provided in relation to the redevelopment of the Birkenhead Point Shopping Centre and Marina Complex. This engagement commenced pre-acquisition by the client and involved a detailed due diligence process through to settlement of the asset.

Read More

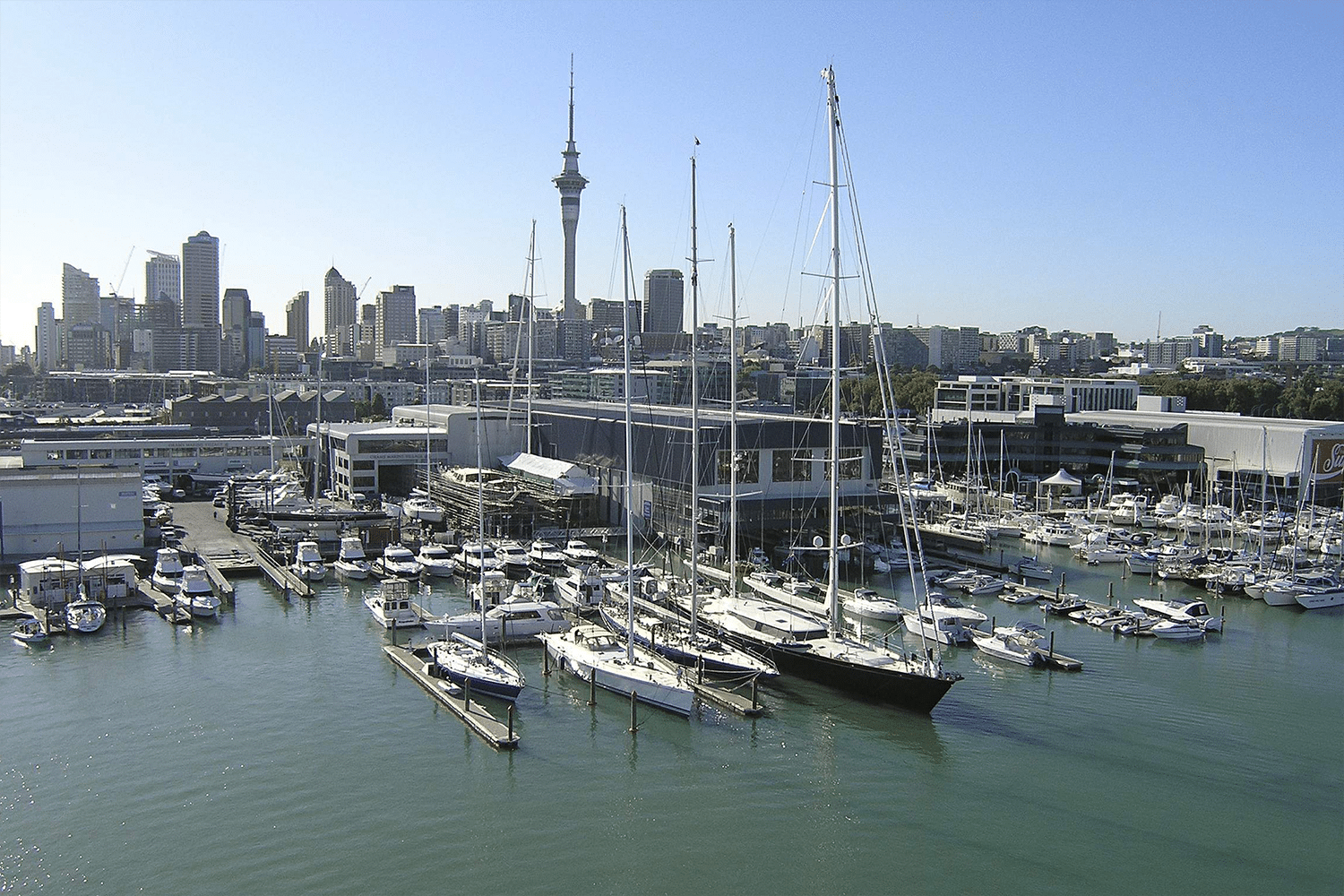

Orams Marine Village, Auckland NZ

Orams Marine Village, Auckland NZ

Orams is an operating marine / property-based asset including a 350-vessel dry stack storage, 40 wet berth marina for vessels up to 60 meters, refuelling facility, an international Super Yacht Slipway and vessel repair yard accommodating yachts up to 600 tonne and 185 feet. These facilities are complemented by a full marine service centre covering all aspects of refit and repair along with a conference/departure lounge facility.

Read More

Batemans Bay Marina Redevelopment

Batemans Bay Marina Redevelopment

This redevelopment project is a fully integrated staged marine orientated development including a total of 240 wet berths and a 250 boat dry stack facility. Plans to incorporate commercial, retail, tourism precincts and 60 serviced apartments were also proposed. The development has been recognised as a State Significant Project and required a Part 3a Environmental Assessment Project Application to be undertaken.

Read More

Mariners Cove, Seaworld Dr. Southport Spit

Mariners Cove, Seaworld Dr. Southport Spit

This asset is a mixed-use tourism and marina development site consisting of berthing, fuelling and retail tenancies. The property included 22 retail, restaurant and showroom tenancies, a 110-bed backpacker resort, tavern and 110 marina berths. The first three stages of refurbishment focused on rejuvenating the appearance and functionality of the centre taking it to 100% leased.

Read More

Viridian Noosa, Noosa Hill

Viridian Noosa, Noosa Hill

This development consists of three stages totaling 10.5 hectares and is contained within a larger 10 hectares of prime land above Hasting Street on Noosa Hill. Stages 1 & 2 delivered 8 stand alone houses and 23 Villas all pre sold and completed on time and budget. The third and largest stage comprised a resort village with 192 Villas and apartments, conference centre, health spa, restaurant and bar in separate buildings is now the 5 star Peppers Resort. The projects were completed 2010.

Read More

Sebel Noosa, Hastings Street, Noosa

Sebel Noosa, Hastings Street, Noosa

The Sebel Resort Noosa features 112 luxury apartments in six blocks overlooking a retail precinct arranged around a pedestrian plaza. The retail precinct comprises nine specialty retail shops and restaurants with frontage to Hastings Street. David was part of the development management team on this project from the commencement through to the final handover of apartments and retail tenancies.

Read More